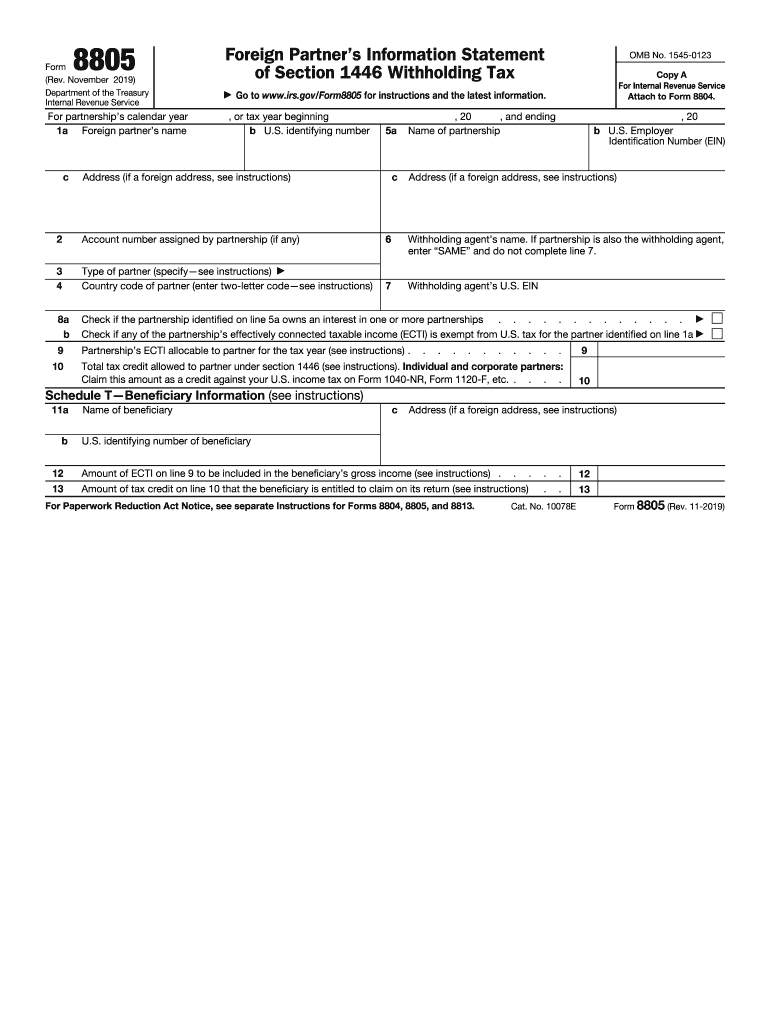

IRS 8805 2019-2026 free printable template

Instructions and Help about IRS 8805

How to edit IRS 8805

How to fill out IRS 8805

Latest updates to IRS 8805

All You Need to Know About IRS 8805

What is IRS 8805?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS 8805

What should I do if I realize I've made a mistake on my IRS 8805?

If you discover a mistake on your IRS 8805 after submission, you'll need to file an amended return to correct the errors. To do this, use the correct form and indicate that it is a correction. Ensure you clearly state the reason for the amendment to avoid delays in processing.

How can I verify if my IRS 8805 has been received and processed?

You can verify the status of your IRS 8805 by checking the IRS website or calling the IRS directly. Make sure you have your details handy to assist in the verification process, including your taxpayer identification number and details of the submission.

What are some common errors that can occur when submitting IRS 8805?

Common errors when submitting IRS 8805 include incorrect taxpayer identification numbers, missing signatures, and mismatched amounts reported. It's advisable to review your form thoroughly, cross-check information for accuracy, and ensure all required sections are completed to minimize the risk of rejection.

How long should I retain my records related to the IRS 8805?

You should retain your records related to IRS 8805 for at least three years from the date of filing or two years from the date you paid your tax, whichever is later. This retention period is essential for reference in case of audits or inquiries from the IRS.

What should I do if I receive an audit notice regarding my IRS 8805?

If you receive an audit notice concerning your IRS 8805, respond promptly by gathering all relevant documentation and evidence to support your filing. It's also advisable to seek assistance from a tax professional to navigate the audit process effectively.