Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

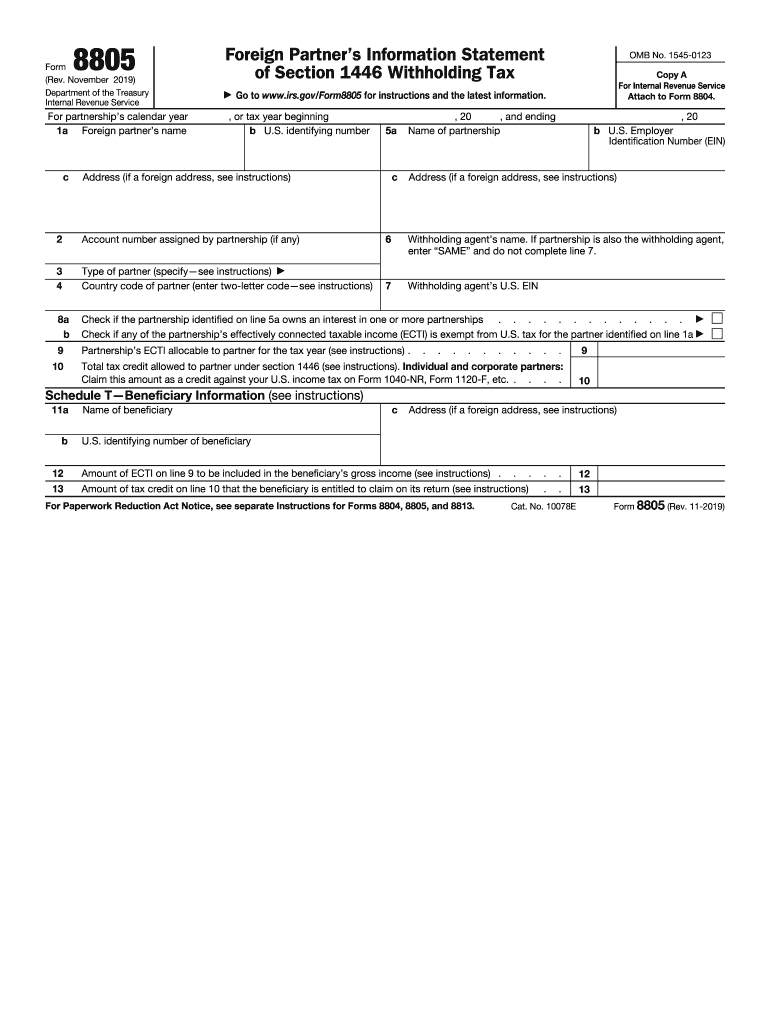

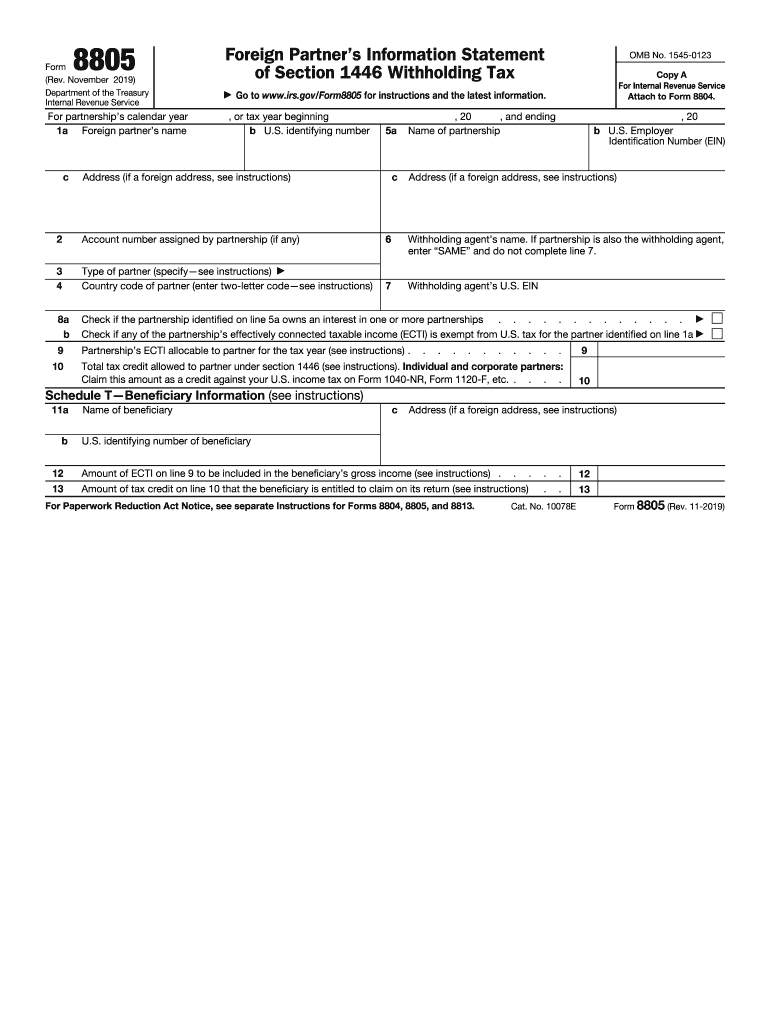

Form 8805 is a tax form used by foreign partners in a U.S. partnership to report their share of partnership income, deductions, and credits. This form is specifically used for reporting income from effectively connected trade or business activities within the United States. Foreign partners are generally subject to U.S. tax on their share of the partnership's effectively connected income. Form 8805 is filed annually and includes details regarding the partner's share of income, expenses, withholding tax, and any adjustments or credits related to the partnership.

Who is required to file form 8805?

Form 8805 is filed by foreign partners or beneficiaries of partnerships and trusts that generate certain types of income in the United States. These types of income include effectively connected income (ECI), gains from the sale or disposition of US real property interests (USRPI), and certain other types of income subject to withholding.

How to fill out form 8805?

Form 8805, also known as the Foreign Partner's Information Statement of Section 1446 Withholding Tax, is used by foreign partners or beneficiaries to report income and deductions from a partnership effectively connected with the United States trade or business. Here are some steps to fill out the form:

1. Obtain the Form 8805: You can get the form from the official website of the Internal Revenue Service (IRS) or your tax preparer.

2. Provide general information: Fill in your name, address, and taxpayer identification number (TIN) at the top of the form.

3. Choose the appropriate section: Identify the section under which you are filing the form and mark the corresponding box (either "Section 1446(f)(1) withholding" or "purported distributions").

4. Reporting period: Indicate the beginning and ending dates of the tax year for which you are reporting the income and deductions.

5. Partnership information: Provide the partnership's name, address, and TIN. If the partnership has already filed Form 8804-C, you should attach a copy to your Form 8805.

6. Income and deductions: Report the amounts of effectively connected income you received from the partnership during the tax year. Additionally, report any deductions related to the partnership income.

7. Withholding and tax payments: Enter the amount of Section 1446 withholding tax paid by the partnership on your behalf during the tax year.

8. Signature and certification: Sign and date the form, certifying that the information provided is true, correct, and complete to the best of your knowledge.

9. Attachments: If needed, attach any supporting documents or schedules required to substantiate the income and deductions reported on Form 8805.

10. Submission: Keep a copy of the completed form for your records and submit the original form to the IRS according to their instructions.

It is highly recommended to consult with a tax professional or certified public accountant (CPA) for assistance in filling out Form 8805, especially if you are unfamiliar with U.S. tax laws or if your situation involves complex partnership structures.

What is the purpose of form 8805?

The purpose of Form 8805 is to report the partner's or shareholder's share of income, deductions, credits, etc., from a U.S. partnership, U.S. real estate mortgage investment conduit (REMIC), or U.S. publicly traded partnership (PTP) to foreign partners or shareholders. It is used to report the U.S. income that needs to be taxed on the foreign partners' or shareholders' tax returns. Form 8805 is submitted by the partnership or PTP to provide the necessary information to the foreign partners or shareholders for reporting their share of income.

What information must be reported on form 8805?

Form 8805 is used to report any partnership's or U.S. real property holding corporation's withholding tax liability on effectively connected income allocated to its foreign partners or shareholders. The required information to be reported on Form 8805 includes:

1. General Information: This section requires the taxpayer's name, address, taxpayer identification number (TIN), and the tax year being reported.

2. Partnership or Corporation Information: This section includes details about the partnership or U.S. real property holding corporation, such as its name, employer identification number (EIN), and tax year.

3. Income Subject to Withholding: The taxpayer must report the amount of effectively connected income (ECI) subject to withholding for foreign partners or shareholders.

4. Allocation of Withholding Credit: If any portion of the withholding tax was passed through to partners or shareholders, the taxpayer must allocate and report the amount of withholding credit to be claimed.

5. Certification and Signature: The taxpayer is required to certify the accuracy of the information provided and sign the form.

It is important to note that Form 8805 is used to report the tax liability and withholding, but it does not involve payment. The actual payment of the withholding tax must be made separately using Form 8813.

When is the deadline to file form 8805 in 2023?

The deadline for filing Form 8805 in 2023 will depend on the specific situation and taxpayer. In general, Form 8805 is typically filed annually by partnerships and foreign corporations to report and pay their partners' and shareholders' shares of effectively connected taxable income. The deadline for filing Form 8805 is usually due on the 15th day of the 4th month following the end of the partnership or corporation's tax year. However, it's important to consult the official IRS guidelines and instructions or seek professional tax advice to confirm the exact deadline based on your specific circumstances for the year 2023.

How can I manage my form 8805 instructions directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 8805 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get w 4 withholding calculator?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific form 8805 and other forms. Find the template you need and change it using powerful tools.

Can I sign the how many allowances should i claim electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your withholding tax calculator form.